On March 10, 2000, I was at Cornell’s Johnson School about to start a lecture on private equity performance. It was the internet silly season and every university’s entrepreneurial programs were in full swing as everyone was convincing everyone else that:

- The old rules were no long in effect

- Anyone over the age of 30 was just clueless about how this new economy was working

- Anyone with a website was now an internet company

- Just show up with an idea and venture investors would chase you to your rental car in the parking lot and offer you a term sheet sight-unseen.

- Incubators were the future

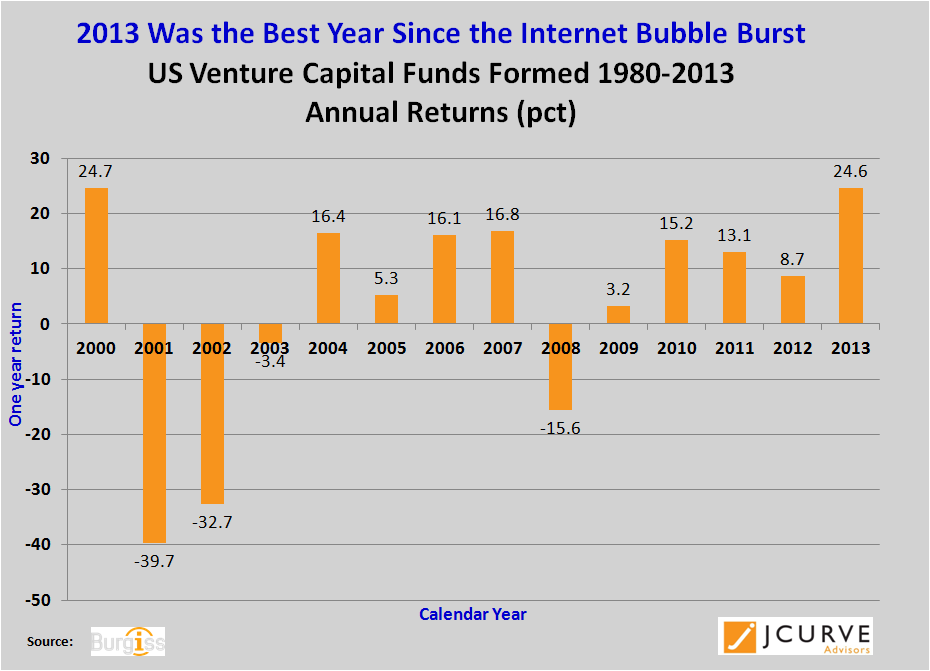

To validate all this the new-tech laden NASDAQ was on a tear and on this particular day it hit an interday high of 5132.52 and closed at 5048.62 which was up 24% since the prior year end just 70 days earlier and was the 16th record for the year. This was an annualized return of 112% so was absolute proof that points 1 through 5 were true.

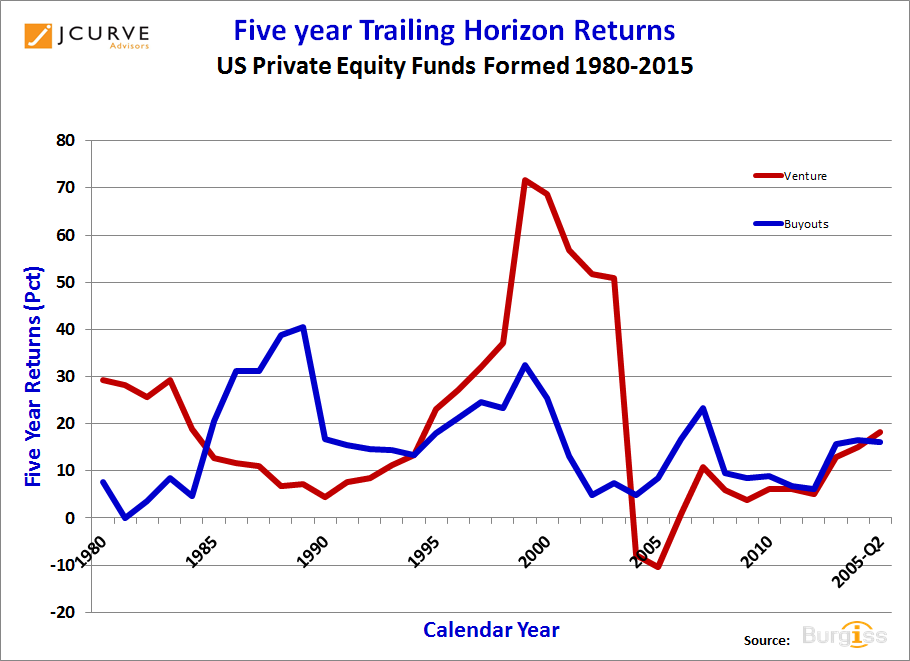

In the midst of all this, venture funds were trying to invent and re-invent themselves to keep up with the manic-panic of the prior five years of investing.

As I was waiting for my classroom to be cleared out, I stepped into the back of another classroom where a venture capital investor who had started an incubator was finishing up a guest lecture.

One final parting comment he made was particularly notable:

“We have perfected venture capital, we will have no failures”

My instinct was that it was a great ending catch-line for a bunch of eager-wanna-be-venture-investor students, but also found it to fairly typical of the hubris the industry felt at the time. Of course being an incubator, which was novel at the time, he probably meant that they wouldn’t let an idea out of the hatchery until it was truly market-tested and if it wasn’t they would rearrange or merge the prospect LEGO-blocks into an even better idea.

Anyway – fast forward 30 minutes, and I was chatting with a few students as I was prepping materials. One student came to me and asked if I had seen the lecture with the venture investor. I said I had and he asked if I had heard his last comment.

“Professor Reyes, if you were a technical analyst, would you consider that a market-top signaling event”

I chuckled with some off-hand remark and didn’t think about it again.

Who knew he was so prescient – I kinda wish I remember his name and hope he’s a stock analyst and hugely successful.

That day WAS the market peak as three days later, Japan entered a recession and by March 20 when MicroStrategy had to restate revenues due to aggressive accounting practices and fell 60%+, and then a never-ending cascade of “the emperor wears no clothes” news like Microsoft anti-trust ruling and the pets.com debacle and by year end the market had dropped 51% from that peak and most internet stocks had lost much more than that. The NASDAQ never got back to that level again until July 18, 2016.

Jesse Reyes