by Jesse Reyes

Cambridge Associates just announced a “New Method to compare public market and private market returns”. see press release

Comparing private equity returns to public market returns has always been problematic since private equity has been firmly ensconced in the Internal Rate of Return (IRR) while the public markets have been measured by time-weighted returns – the two returns are incommensurable directly (more on that in a later post)– although that doesn’t stop the financial and mainstream press from doing just that-much to my (as well as that of many of my quant’s brethren’s) chagrin.

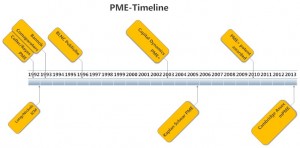

The Cambridge Associates method is the latest in a series of alternative approaches to direct public/private market comparison which first surfaced about 20 years ago.